Health Care Facts:

More and more people are realizing they should think about their health before something happens to put it in danger. Whether you are healthy, haven’t been seen by a doctor in years, or have a medical condition or concerns, no one is immune from the possibility of a catastrophic accident or the diagnosis of a serious medical illness.

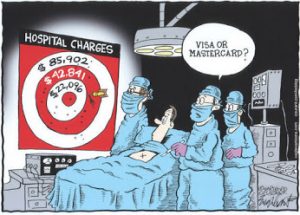

How much room is there in your budget for an emergency hospital stay or operation?

Here are the estimated costs of some routine check-ups and surgeries:

Automatic Defibrillator: $33,364

Cataract: $7,038

Chest Pain: $4,023

Cardiac Pacemaker: $14,710

Follow-Up Surgery: $7,082

Abdominal Pain: $2,277

Pre-Operation Exam: $920

Lower Back Pain: $1,920

Carpal Tunnel Syndrome: $6,214

Unfortunately, these fees only cover the actual surgery or exam; there are additional costs for medication, check-up visits, hospital stays, anesthesia and more. In today’s world, even minor surgeries and preventive care easily accrue overwhelming bills.

The reality is NO ONE can afford not to purchase health care benefits. In the event of an accident, injury or illness, medical treatment is not a luxury, it is a necessity.

Now that you realize that you should have a health care plan, you should consider the following in order to get a plan that is right for your situation.

Do you need just medical benefits alone?

Do you need a dental plan?

Do you need a vision plan?

Do prescriptions need to be covered?

What is it going to cost each month?

If you are traveling will you be covered?

There are basically two different health care options to choose from, either an insurance or a discount plan. Below is an explanation of each option. Study both then decide which one that is the best value for you and, has the benefits that you need.

Health Insurance

Health insurance companies use historical data and analysis to predict the medical expenses for any given group of individuals (usually a company’s employees). The premiums they charge are based on the amount of claims they’ve paid in the past and what they expect future claims to cost. When insurers pay out more in claims than they receive in premiums and when future services are predicted to cost more, premiums go up.

About 90 percent of every health insurance premium dollar goes directly to pay for medical care for everybody (including all of the people that are insured by the health insurance company) covered by your health plan. The rest pays for the services that help you get the care you need, claims processing, customer service, member communications, provider relations and reserves for future claims.

Standard benefits:

It will pay a pre-determined dollar amount of healthcare costs – except for your copayments – before you start paying toward a deductible, as long as the costs are for covered services from in-network providers.

Once the allowance is spent, you have a deductible amount to meet.

After you meet the deductible, you and the insurance company share in the cost of most additional eligible medical expenses until you’ve met an annual out-of-pocket maximum amount.

You pay only a copayment for preventive care office visits, even after your pre-determined dollar amount is gone; copayments don’t count toward the deductible or out-of-pocket maximum, and you can’t use the preset dollar amount to cover copayments.

Traditional types of Insurance plan:

Preferred Provider Organization (PPO) allows you to decide whether you want to use in-network doctors or not. If you “step outside the network,” your copayment, deductible, and coinsurance costs will be higher – sometimes significantly higher.

Health Maintenance Organization (HMO) is when you must select a Primary Care Physician, one who tends to do the majority of your health needs and refers you to other in-network providers, if necessary. Referrals to specialists may be required. Coverage for services from out-of-network providers is only provided for emergencies or when the insurance company has given prior authorization.

Point of Service (POS) plans combine the advantages of a Health Maintenance Organization (HMO) plan with the flexibility of a Preferred Provider Organization (PPO) plan option that allows members to choose medical services that are needed and whether they will go to a provider within the plan’s network or seek medical care outside of the network.

The cost of each of these plans will vary from a few dollars to several hundred dollars per month depending on if it covers only major medical costs, or if it includes other services such as dental, vision, and prescription.

Some can pay the premiums with no difficulty, but utilize their disposable income in doing so; others have some insurance but not enough to cover some members of the family; and the rest of this middle group have no health insurance, as they make too much money to qualify, for Medicaid and too little to afford premiums. Also in this middle group you’ll find most of your small businesses and those who are self-employed, and together they comprise the bulk of U.S. workers. Small business generally can’t afford health care insurance without affecting the price of their goods and service so they go without.

Discount Plans:

Generally, discount plans work by charging a flat fee in order to receive per visit discounts when you seek medical care. If you have a pre-existing condition or financial limitations, these plans will give you a way to make doctor visits, treatment, prescriptions and other services affordable. Even if you currently have health insurance and are paying costly out-of-network fees to see specialists or paying large sums for uncovered medical services, a discount plan can also provide substantial relief.

Discount plans like AmeriPlan® were formed for the purpose of providing necessary health coverage to members at an affordable fee. Depending on the plan that you choose, AmeriPlan® can give you savings on medical, dental, vision, prescription, chiropractic, quit smoking, wellness, hearing, phone access to a doctor, discount hospital stay, blood work, lab, MRI, CT scans, and more…

Be sure you get the health plan to match your needs here . Always keep in mind that a Discount Health Plan is not insurance. Even with a discount plan, you pay the doctor or pharmacy for all fees out of your own money.

Benefits of a Discount Plan

AmeriPlan® offers discounts of 25% to 80% on dental, medical, for example, the doctor you will see as part of this system has already agreed to participate in the discount service by signing a contract. They have agreed to a lower percentage of their normal fees and this percentage is passed on to you.

Having a discount card will help you get more services for your money. The out-of-pocket cost will go further with AmeriPlan®. You should join now to avoid paying out a lot of cash on health care services and prescriptions.

For those people who cannot get health insurance because of a pre-existing condition, AmeriPlan® will not exclude you from joining. Unlike an insurance company, discount health companies do not pay the health provider for any services; they only guarantee discounts to you as a member. It is vastly different from insurance in the following ways:

NO Ongoing Medical Problem Exclusions

NO Waiting Periods

NO Long Term Commitments

NO Age Limits

NO Hassles … and

NO Limits to How Many Visits or Number of Services.